Third Quarter 2023

Check out AssetGrade’s review of the markets for the Third Quarter 2023. Learn more about the challenges markets faced this quarter and what to consider as we look toward year end.

Getting Started with “The Essential Investor”

By: Patrick R. Cote CFA, CFP®

Many of our clients have asked us how they or their family members can best learn the basics of investing. They don’t necessarily want to start making trades themselves, however they do want to understand the key elements of investing. The challenge in doing so is that there is so much information available that it is not clear where to start.

Smart Spending Strategies for Kids

By: Kate Hennessy, CFP®

Our daughters like to spend money and since we fund most of their purchases, it’s difficult for my husband and me to quantify how much they spend each week. Like most of us, our kids spend money on items that bring them joy, such as ice cream and beauty products.

De-Risking Your 529 Plan

By: Kate Hennessy, CFP®

This month thousands of students will graduate from high schools across the country.

Dream Vacation – What is Yours?

BY: SUSAN POWERS, CFA, CPA, CFP®, CPFA®

Travel is up 25% over last year with 85% of adults planning to travel this summer. The average cost of a dream vacation for two can vary greatly depending on factors such as the destination, duration of the trip, type of accommodation, and personal preferences.

You Need a Reason to Get Out of Bed in the Morning

By: Patrick R. Cote CFA, CFP®

“You need a reason to get out of bed in the morning.” That was the advice from a serial entrepreneur I worked for at a startup in the dot com era back in 2000. At the time, I had asked him why he kept going, even though he was already quite wealthy.

The True Cost of Moving

By: Kate Hennessy, CFP®

As a financial planner, I often speak to my clients about life’s big transitions. After having gone through my own major life transition this year, I decided to write about what’s involved with selling a home – the cost of moving and the factors to consider when allocating your sale proceeds to your new mortgage. Let’s tackle cost first. The first thing most people think about when preparing to sell a home, is how much they may profit from the transaction.

Do You Need a New Advisor?

BY: SUSAN POWERS, CFA, CPA, CFP®, CPFA®

Have you relocated recently? Do you find yourself wishing you could sit down and talk with someone in person? Maybe you are contemplating an early retirement or will be receiving an inheritance. Do you have an advisor you can call that knows you and is there to a

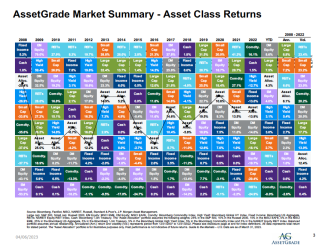

The New Normal is Actually the Old Old Normal

By: Patrick R. Cote CFA, CFP®

For over a decade, interest rates have been near zero, a phenomenon that had never been seen before in the US. Now with the US over a year into a rising interest rate environment, we are starting to see a return to the old old normal.

Radio Appearance: Kate Hennessy On Your Money Matters On WGN Radio

Kate Hennessy, Certified Financial Planner with AssetGrade, LLC joins Jon Hansen on Your Money Matters to share how they make investing and managing clients’ assets a personal and seamless experience. Listen in while Kate dives deeper into what her specialties are, including a focus on families, women investors and college planning and what the first steps are to getting a handle on your expenses.

April 2023 Market Review

Check out AssetGrade’s review of the markets for the First Quarter 2023. Learn more about what caused the markets to rebound and the economy to slow.

Radio Appearance: Kate Hennessy On Your Money Matters On WGN Radio

Kate Hennessy, Certified Financial Planner with AssetGrade, LLC, joins Jon Hansen to talk financial planning. They break down how listeners can maximize benefits from a Health Savings Account, what a fiduciary is, and many other things to know that may be important for retirement or college savings.