Do You Worry About Paying for High School or College?

Every year at this time our neighbourhood is filled with lawn signs congratulating students for graduating from elementary, middle, or high school. For graduates, it’s an emotional time of year, particularly for teenagers who leave schools where they were accustomed to routines and embark on a new stage in their life - whether that be high school, college, or perhaps a different path altogether. For our family, we are celebrating our oldest daughter’s graduation from 8th grade.

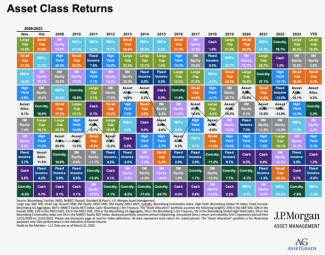

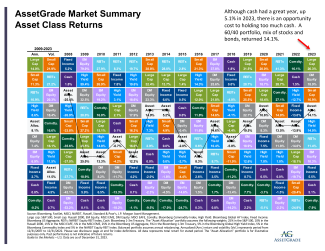

Understanding the Asset Class Periodic Table

The asset class periodic table is a useful tool to help investors understand the characteristics of different types of investments and how they may fit into a diversified portfolio. Let’s begin with the end in mind.

The asset allocation portfolio (white box in every column) illustrates how spreading investments across a variety of asset classes can reduce overall risk with more consistent relative returns: never at the top, never at the bottom.

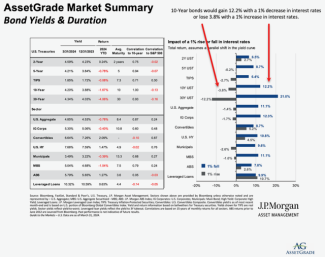

Bonds Are Not Always Boring

Bonds are intended to be one of the less exciting, some might even say boring, parts of most people’s portfolios. For retirees, bonds often make up a large part of the portfolio in order to generate needed income. For people saving before retirement, bonds take on the role of stabilizing the portfolios, so they are not completely subject to the ups and downs of stocks.

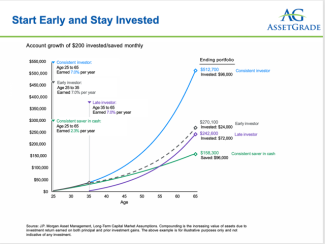

Keep Your Eye On The Prize

In life, focusing on what’s within your control can be easier said than done. The same can apply to investing and planning for retirement. With investing and planning for retirement, there is more that is out of control, than within our control. Try not to get distracted by social media or volatile markets, and instead focus on what’s within your control including saving, investing and diversifying across asset classes.

Let’s start with the importance of starting early and staying invested to take advantage of compounding your investment returns.

2024 April Market Review

As they did last quarter, US large cap returns continued to dominate, up 10.6% in Q1. US stocks are now at all-time highs and near-record valuations.

2024 January Market Review

2023 was an interesting year in the equity and fixed income markets. Check out AssetGrade’s review of the markets for 2023. Learn more about the markets, inflation, resilient US consumer, and importance of staying invested.

Three Simple Estate Planning Tips

BY: KATE HENNESSY, CFP®

Some people associate estate planning with death, others feel it is time consuming and costly, it doesn’t have to be. Here are three estate planning tips to help you start protecting your assets for you and your loved ones:

Five Year-End Tax Tips

BY: SUSAN POWERS, CFA, CPA, CFP®, CPFA®

As we approach year end, here are five tax tips to help minimize your tax liabilities and make the most of your financial situation:

How to Fight Inflation Through TIPS or I Bonds

BY: PATRICK R. COTE CFA, CFP®

With higher inflation continuing to persist, there are two main investment options that have become attractive in order to generate returns greater than the inflation rate.

For emergency funds, it is a good idea to keep your money in safe and accessible investments. We mentioned I bonds a couple of years ago, when they were paying out up to 9%, which was attractive back then compared with bank account rates of near zero!