SECURE ACT 2.0 – What You Should Know

BY: Patrick R. Cote, CFA, CFP®

The SECURE 2.0 Act of 2022, the most recent tax legislation, covers a lot of areas. While most provisions are relatively minor, the changes worth noting are extending ages for RMDs (required minimum distributions), new additional Roth choices and increasing the ability to both contribute and withdraw from retirement plans.

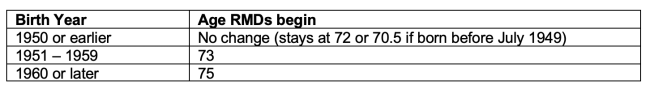

Effective 1/1/2023, the changes for the RMDs are:

Many people will have already started distributions from their retirement plans prior to age 75, so these RMD age limits may not matter. For those who are able to wait until age 75, they may have significant other sources of income (e.g., defined benefit plans and/or taxable investments in brokerage accounts). Because of that, it might not be tax-efficient to wait until age 75 to start distributions from IRAs – each person should assess their tax situation to minimize the tax impact over multiple years. The good news is that the later age limits allow more flexibility for each person. For example, some people may choose to do a Roth conversion in their late 60s if they have stopped working and have minimal income, before they do a deferred start for Social Security at age 70. In addition, the penalty for missing RMDs used to be 50% - it is now dropping to 25%, further reduced to 10% if fixed in a timely manner.

As a quick reminder, Roth plans involve making after-tax contributions now, which then grow tax-free and are later withdrawn tax-free (assuming tax rates will be higher for that person in the future). Pretax plans involve making deductible pretax contributions now, with growth tax-deferred, then any withdrawals are taxed as income in the future (assuming tax rates will be lower for that person in the future). The new Roth changes in SECURE 2.0 are:

- Employer contributions for 401K plans can now be either Roth or pretax (previously were required to be pretax)

- In 2024, employees with wages >$145K can only make Roth catch-up contributions

- Both SEP IRAs and SIMPLE IRAs can now be Roth

- Unused 529 balances can be transferred to Roth IRAs (see Kate’s article this month)

Even before SECURE 2.0, limits for retirement plan contributions had already gone up for 2023, to reflect higher inflation. The employee contribution limit for 401K, 403B and most 457 plans is now $22,500, with a catch-up limit of $7,500 for people aged 50 or older. In 2025, the catch-up provisions for employees aged 60 – 63 will increase to $10,000 or 150% of the normal catch-up contribution limit.

There is now a post-death option available for surviving spouse beneficiaries of retirement plans to be treated as the decedent for RMD purposes. This can allow the beneficiary to decide which approach works better. For example, if the deceased spouse was younger, the RMDs would be delayed until the deceased spouse would have reached RMD age.

As you might assume, there were many other provisions in the 350 pages of the SECURE 2.0 Act, however, most of them were relatively minor. For more specific questions regarding this new tax law, please contact your tax advisor.