Thank You, Thank You, Thank You!

2026 January Market Review

AssetGrade Market Summary – January 2026 Celebrating a strong 2025 and cautiously optimistic for 2026.

What to do with Capital Gains Before Year-End

Catch-up Contributions in 2026

2025 October Market Review

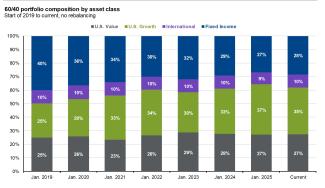

International markets continue to perform well as emerging markets stood out as the best performing asset class year to date through September 30th.

The OBBBA Act: 4 Key Provisions That May Affect You

Hello Friends,

We hope you had a wonderful summer with family and friends! As we look ahead to fall, we want to highlight an important development: the One Big Beautiful Bill Act (OBBBA), signed into law on July 4th.

This sweeping legislation includes a wide range of tax provisions impacting both individuals and businesses. In this month’s newsletter, we’ll preview a few of the most significant changes. Over the coming months, we’ll dive deeper into each of these topics and explore what they could mean for you.

2025 July Market Review

The strong diversification story continued in the second quarter, as international and emerging markets outperformed the US markets.

Why We Should All Put a Credit Freeze in Place

Credit freezes are one of the most effective, yet least-discussed, techniques to prevent identity theft. They might be little-known because no one, including the credit bureaus, actually makes any money from a credit freeze – unlike credit locks, they are now provided for free. Putting a credit freeze in place prevents the credit bureaus from sharing your credit report with any third parties, which makes it hard to establish new credit. The freezes are very useful for each of us, because they help to prevent a significant loss of time

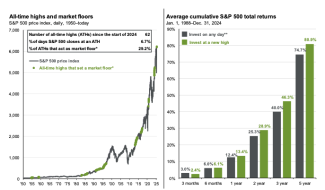

April Angst: A Reminder from the Market, Timing Rarely Pays

Let’s talk about April 2025.

It was the kind of month that gives market watchers whiplash and reminds long-term investors why patience and maybe antacids are needed at times. On April 2nd, President Trump declared “Liberation Day,” unveiling a sweeping package of tariffs: 10% on all imports, with even higher rates on Chinese and European goods. The market reacted with a sharp decline.

Roth IRA for Kids

Today there are many opportunities to help a child invest for their future, and to teach a child about the importance of saving. While savings accounts still exist, there are now tax efficient ways, such as a Roth IRA, to teach a child to save for his or her future.

2025 April Market Review

Diversification worked in the first quarter, as international stocks outperformed their US counterparts by 11%, the widest margin of outperformance since 1989.

What’s Ahead for 2025

It’s not too soon…a look ahead to the 2025 tax year

While we are all busy filing our 2024 tax returns, there are potential tax law changes coming in 2025 that merit paying attention to the impact on your portfolio. While your current tax situation is top of mind, taking the time now to anticipate future tax changes will give you more time to plan, and if necessary, to act to minimize any impact.

Provisions of the 2017 Tax Cuts and Jobs Act (TCJA) will expire at the end of this year unless Congress acts. Below are some of the key items we will be monitoring: