How Much Is Enough?

By: Patrick Cote

As we start to emerge from various shelter-in-place orders across the country, Susan, Kate, and I thought that it’s a great time to share an inspirational perspective for this month’s newsletter.

If you read or heard of the book, “The Millionaire Next Door,” you are going to find this month’s newsletter particularly interesting – one of the authors, Dr. William Danko, reached out to me after reading our email newsletter earlier this year. In the late 1990s, a friend from business school told me that I had to read that book. My friend explained that it would change my perspective on money and my friend's prediction turned out to be very true.

“The Millionaire Next Door” not only changed my perspective on money, it planted the seeds for some of the key investment/planning philosophies we use to this day at AssetGrade. Danko and his co-author, the late Dr. Thomas Stanley, had researched US households to find out more about millionaires – who were they, how did they make their millions and what type of behavior did they exhibit? Interestingly, the key insight from the book was that millionaires were typically people who did not spend a lot of money on houses, cars, etc. They often lived relatively middle-class lifestyles.

In 2013, shortly after launching AssetGrade, I had the pleasure of meeting Bill Danko and we quickly realized that we shared a very similar investing philosophy.

Recently, along with Dr. Richard J. Van Ness, Bill wrote a follow-up book, “Richer Than a Millionaire.” Following our recent article, “What Does Being ‘Rich’ Actually Mean?”, Bill reached out to me to draw the connection with the work that he had recently done.

After speaking with many people about wealth over the years, we completely agree with Bill’s results: very few people, including multi-millionaires, feelrich! The key take-away is that it is important to make your goals more about what is important for your life, rather than an abstract idea of just getting rich. As you might expect, this is how we work with our clients – our focus is on a goal-based approach (saving for retirement, kids’ college, second home, security, giving back, etc.), rather than just trying to make people rich. We see first-hand how satisfying it is for people to set specific goals related to long-term wealth, especially as they begin to see progress along the way.

We hope that you enjoy the guest article this month from Bill and Dr. Van Ness highlighting their most recent research - we certainly did!

How Much Is Enough?

By: William D. Danko, Ph.D. and Richard J. Van Ness, Ph.D.

A wise man once remarked: “I have all the money I need if I die today.” True enough, but suppose you don’t die today. Would you feel you had enough wealth to meet your future needs?

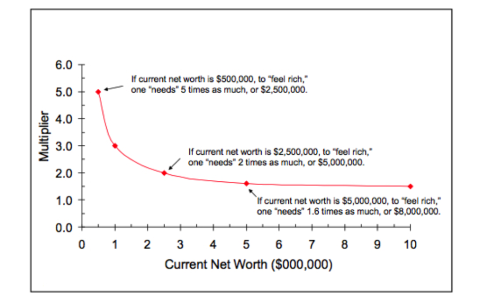

Our study of millionaires and near-millionaires provides insight about how much one needs to feel rich. In brief, as shown in the graph, to feel rich one always needs more than one currently has.

Responses to two survey questions were used to construct the graph. Self-reported current net worth ranged from $100,000 to over $20,000,000. The follow-up question asked how much would be needed to feel rich. The data show that whatever you have, the more you think you need to feel rich, as shown by the bigger multiplier. Fortunately, the more you have, you only think you need slightly more, as shown by the relatively smaller multiplier. So, if your current net worth is $500,000, to feel rich, you “need” five times as much, or $2,500,000. If your net worth is $5,000,000, to feel rich, you “need” 1.6 times as much, or $8,000,000.

It would be interesting to assess the sentiments of billionaires. Would their multiplier be less than one? More importantly, this exercise demonstrates that perception matters. Feeling rich is a state of mind.

New York Times bestselling author William D. Danko and Richard J. Van Ness, wrote the research-based book, Richer Than A Millionaire ~ A Pathway to True Prosperity, which shows the way to wealth and happiness through embracing traditional values.

Content appearing in this article is inspired by the authors’ book, which is available at Amazon.com. Also, visit RicherThanAMillionaire.com for other articles and interviews.