Catch-up Contributions in 2026

Do you participate in an employer-sponsored 401k Plan and are over 50 years old? Catch-up contributions are additional contributions that employees 50 years and older can make to a 401(k) or similar workplace plan. The primary benefit of catch-up contributions is for individuals to boost their retirement savings and make up for lost time. Currently most employees covered by a workplace plan can either make contributions to their Roth 401k or a pre-tax 401k. If you contribute to your Roth 401k, then you pay taxes on the year you make the contribution.

Alternatively, if you contribute to a pre-tax 401k, the contribution automatically reduces your gross and taxable income. For those employees that are deferring the maximum amount and making a catch-up contribution to their pre-tax 401k, the reduction in taxable income can be significant. For example, an employee age 50 or older in 2025, could reduce their taxable income by $31,000. Taking it a step further, if you are aged 60-63, you are allowed to make a “super” catch-up contribution and can reduce your taxable income by $11,250. So, what’s changing in 2026?

Under new 401k rules that take effect on January 1, 2026, if you earned more than $145,000 in the prior year and you plan to make catch-contributions to a pre-tax 401k plan, those catch-up contributions must be made to a Roth 401k account using after-tax dollars rather than your pre-tax 401k. This change impacts individuals earning more than $145,000 and now limits how much their taxable income can be reduced. For example, if you are an employee aged 50 or older in 2026 and contribute the maximum amount to your 401k and make the full catch up contribution - you can contribute $24,500 to your pre-tax 401k and reduce your taxable income by $24,500, but your $8,000 catch-up contribution will be made to a Roth 401k and you’ll be taxed on this contribution. So, let’s breakdown the numbers and what catch-up limits will be impacted:

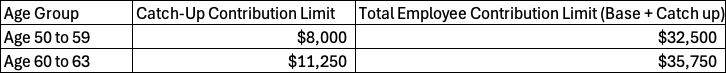

For 2026, the standard catch-up contribution limit for individuals age 50 and older is $8,000. An increased "super" catch-up contribution limit of $11,250 is available for those ages 60 through 63. Below is a table with additional information:

Note: These limits apply to 401(k), 403(b), and most 457 plans.

In summary, this change impacts employees that make greater than $145,000 and make catch up contributions or “super” catch up contributions to a 401k plan or similar workplace plan. Please talk with your tax advisor or financial advisor for any questions about this new rule change and how it may impact you.