Keep Your Eye On The Prize

In life, focusing on what’s within your control can be easier said than done. The same can apply to investing and planning for retirement. With investing and planning for retirement, there is more that is out of control, than within our control. Try not to get distracted by social media or volatile markets, and instead focus on what’s within your control including saving, investing and diversifying across asset classes.

Let’s start with the importance of starting early and staying invested to take advantage of compounding your investment returns.

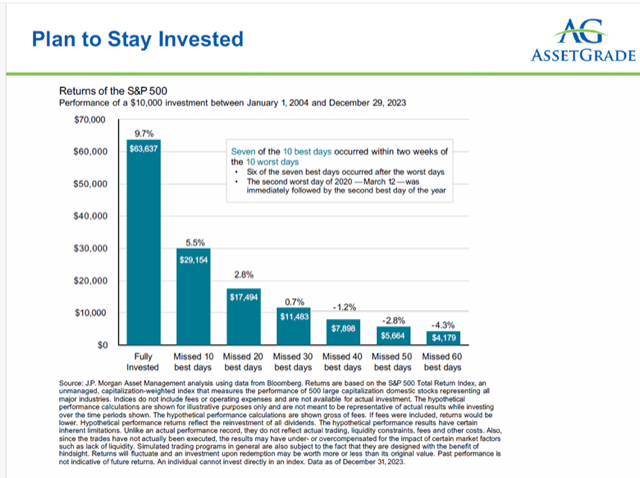

In this graph, four types of investors and their saving outcomes are illustrated. Each invested $200 a month/$2400 a year.

- The late investor – started at age 35, stayed invested in the markets but started 10 years too late.

- The early investor – started at age 25, stayed invested in the markets but stopped adding to savings at age 35.

- The consistent saver in cash – started early at age 25 but stayed invested in cash earning too little over time.

- The consistent investor – started at age 25 and kept going until age 65. The power of compounding returns over a long period of time can be seen in the consistent investor portfolio with the highest value by more than $240,000!

Don’t think you started in time? Start now! Take advantage of every opportunity to maximize your savings. The sooner you start, the sooner your money can work for you.

Staying invested can be difficult during volatile markets and the media coverage can be distracting.

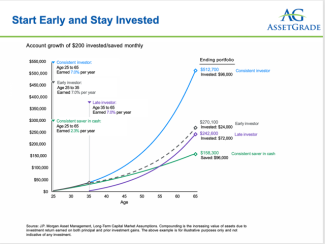

The chart below, illustrates the impact of missing even 10 or 20 days over a period of 20 years or more than 7,000 days.

While it may seem like a good idea to sell when you are concerned about market return, how do you know to when to get back in? Chances are - when you do move back in – you have already missed the best days in the market.

If you missed the 10 best days in the market (just 10 days during this period) your return is 5.5%.

The challenge with trying to time the market is that historically the best days in the market usually occur within the 10 worst days. Hard to get the timing right in such short period of time.

Plan to stay invested.

Losses hurt more than gains feel good. Market lows can result in emotional decision making.

Investing for the long term in a well-diversified portfolio can result in a better retirement outcome.