Bonds Are Not Always Boring

Bonds are intended to be one of the less exciting, some might even say boring, parts of most people’s portfolios. For retirees, bonds often make up a large part of the portfolio in order to generate needed income. For people saving before retirement, bonds take on the role of stabilizing the portfolios, so they are not completely subject to the ups and downs of stocks.

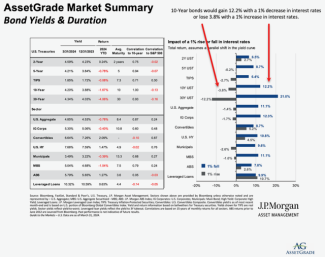

However, bonds themselves can be volatile, as we have seen in the last couple of years. Bonds react in the opposite direction of interest rates, so as rates go down, bonds go up in value (this is mostly what happened for 40 years from 1982 to 2022). When interest rates go up, bonds go down in value – who wants to hold that old 10-year Treasury paying 2% when you can get a shiny new 10-year Treasury paying 5%? The sensitivity of bonds to interest rates is measured by “duration.” As rates get lower, the duration itself gets larger, so when rates were very low a few years ago, bonds became extremely sensitive to interest rate changes. Right now, we still see a bit of this effect for the 10-year US Treasury: a 1% decline in rates would cause the bond to gain 12.2% in value, while a 1% rise in rates would only cause the bond to lose 3.8% in value.